Welcome to the Future of Insurance: Understanding ePojisteni! In a world where convenience reigns supreme, navigating the complexities of insurance can often feel like wading through a labyrinth. Enter ePojisteni—your online compass in this intricate landscape. As we usher in an era dominated by digital solutions, understanding how online insurance platforms work is more crucial than ever. Whether you’re a seasoned policyholder or stepping into the realm of coverage for the first time, our comprehensive guide will arm you with all the knowledge you need to make informed decisions and secure your peace of mind. Say goodbye to confusion and hello to clarity as we explore everything from policy comparisons to claims processing—all at your fingertips! Ready to unlock insurance enlightenment? Let’s dive in!

Benefits of using ePojisteni for insurance needs

Using ePojisteni brings convenience to your insurance journey. You can compare various plans from the comfort of your home, saving time and effort. The platform is user-friendly, guiding you through each step without overwhelming jargon. It’s designed for everyone, whether you’re a first-time buyer or looking to switch providers. Cost-effectiveness stands out as another advantage. With competitive rates available online, you have the potential to secure better deals than traditional methods offer. Additionally, transparency is key with ePojisteni. You’ll find clear information about coverage options and policy details right at your fingertips. Customer support enhances the experience further. If questions arise during your selection process, assistance is readily accessible via chat or phone. Flexibility also plays a significant role; you can revisit your options any time without pressure from sales agents pushing you toward a decision.

How to use ePojisteni: Step-by-step guide

Getting started with ePojisteni is simple. First, visit the official website and create an account. You’ll need to provide some basic information like your name, email address, and contact number. Once registered, log in to your dashboard. Here you’ll find various options for different types of insurance. Take your time exploring each category. Next, select the type of insurance you need. Whether it’s health coverage or car insurance, click on it to see available plans tailored for you. You’ll be prompted to fill out a questionnaire regarding your specific needs. Answer accurately; this helps customize recommendations just for you. After selecting a plan that suits your requirements and budget, review the terms carefully before proceeding to payment. You can make secure transactions through multiple payment methods offered on the platform. Lastly, once everything is confirmed, you’ll receive all relevant documents via email for easy access anytime.

Types of insurance available on ePojisteni

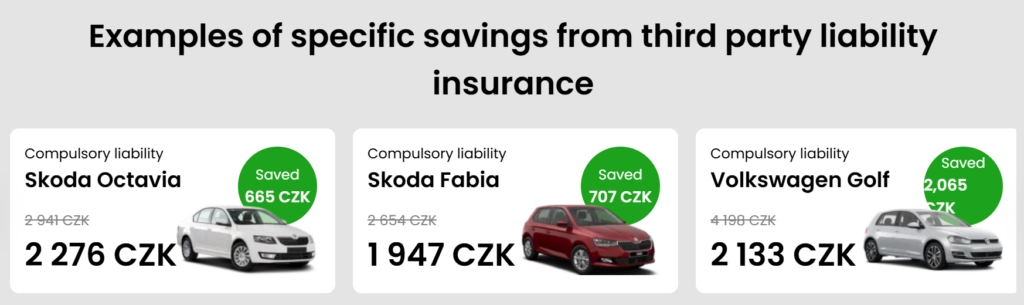

ePojisteni offers a diverse range of insurance products tailored to meet various needs. Whether you’re looking for personal or business coverage, you’ll find something suitable. Health insurance is one of the most sought-after options. It provides essential medical care coverage and financial protection against high healthcare costs. Another popular choice is car insurance. This protects you from liabilities arising from accidents and damages to your vehicle. Homeowners can also benefit from property insurance available on ePojisteni. It safeguards your home and belongings against unforeseen disasters like fire or theft. Additionally, travel insurance helps ensure peace of mind during your trips by covering unexpected events such as cancellations, delays, or even medical emergencies abroad. Lastly, life insurance plans provide financial security for loved ones in the event of an untimely passing. Each type serves a unique purpose, making it easy to find what fits your situation best.

Tips for choosing the right insurance plan on ePojisteni

Choosing the right insurance plan on ePojisteni can be a straightforward process with the right approach. Start by assessing your specific needs. Consider what coverage is essential for you, whether it’s health, auto, or home insurance. Next, take advantage of comparison tools available on the platform. They allow you to evaluate different plans side-by-side based on premiums and benefits. Don’t overlook policy terms and conditions; they hold crucial information that can affect your decision. Make sure you understand any exclusions or limitations. Seek customer reviews to gauge satisfaction levels from others who have used the service. Their experiences can provide valuable insights into how reliable a particular plan might be. Lastly, consider consulting with an online advisor if you’re unsure about your options. They can help clarify doubts and guide you towards a plan that fits both your budget and requirements perfectly.

Success stories of individuals who have used ePojisteni for their insurance needs

Many individuals have found success through ePojisteni, transforming their insurance experience. One user, Anna, switched to an online policy for her car insurance. She appreciated the convenience and saved money without sacrificing coverage. Another story comes from Tomas, a small business owner. He used ePojisteni to find the best health insurance for his employees. The platform allowed him to compare plans effortlessly and choose one that met everyone’s needs. Then there’s Petra, who discovered life insurance options she never knew existed. With just a few clicks, she secured a plan that gave her family peace of mind at an affordable rate. These stories showcase how ePojisteni empowers users by simplifying the process and providing tailored solutions for diverse needs in today’s fast-paced world. Each experience highlights not only ease but also confidence in making informed decisions about important coverage choices.

Frequently asked questions about ePojisteni

Many users have questions about ePojisteni and how it operates. One common query is whether the platform is secure for personal information. Yes, ePojisteni employs advanced encryption methods to protect user data. Another frequent question concerns the types of insurance available. Users can find everything from health to vehicle insurance, making it a versatile option for diverse needs. Some wonder if customer service support exists through ePojisteni. The platform offers assistance via chat and email, ensuring users get help when needed. People also ask about policy customization options. Fortunately, many insurance plans on ePojisteni allow adjustments tailored to individual requirements. Lastly, many are curious about the claims process. It’s streamlined on this platform, simplifying what can often be a complicated experience in traditional settings.

Conclusion: The future of online insurance with ePojisteni

The landscape of insurance is evolving, and ePojisteni is at the forefront of this change. With its user-friendly platform and comprehensive offerings, it simplifies the way individuals approach their insurance needs. As more people turn to online solutions for convenience and efficiency, ePojisteni stands out by providing transparency and a wide range of options. This shift towards digital platforms reflects a broader trend in consumer behavior—people are looking for speed, accessibility, and control over their choices. The future likely holds even greater innovations in online insurance services, enhancing customer experiences further. By embracing such advancements like those offered by ePojisteni, consumers can look forward to not just meeting their insurance requirements but doing so with confidence. This emerging model promises to redefine how we think about protection—making it more inclusive than ever before.